Opportunity zones offer an exciting way for investors to take advantage of the lucrative senior housing market. Here are a few important things to understand about this type of investment.

Opportunity zones offer an exciting way for investors to take advantage of the lucrative senior housing market. Here are a few important things to understand about this type of investment.

What is an Opportunity Zone?

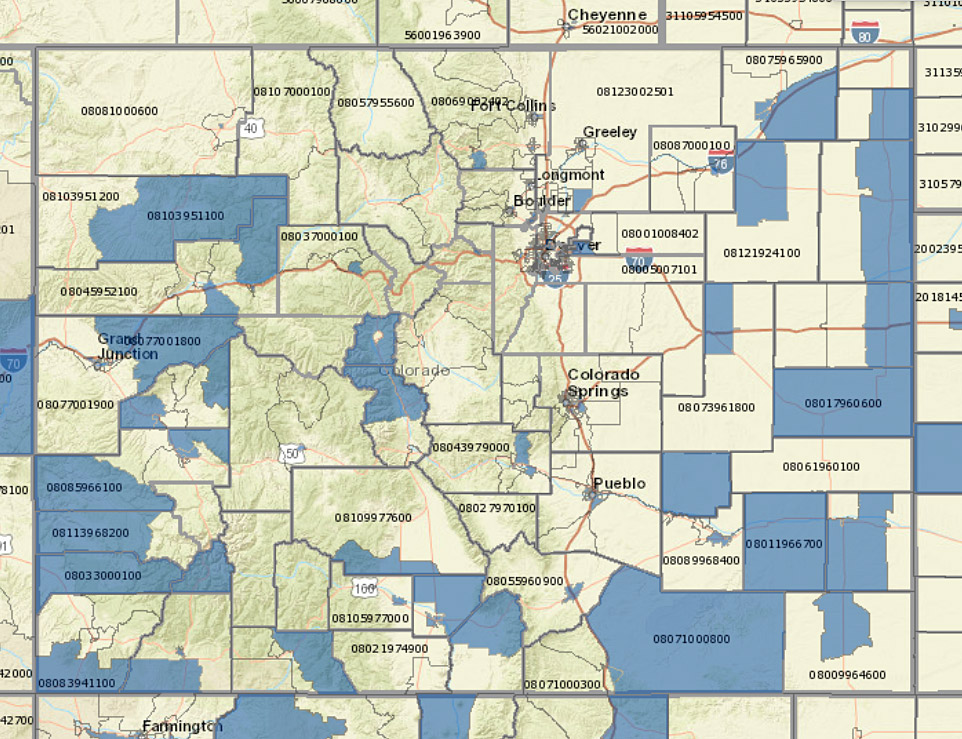

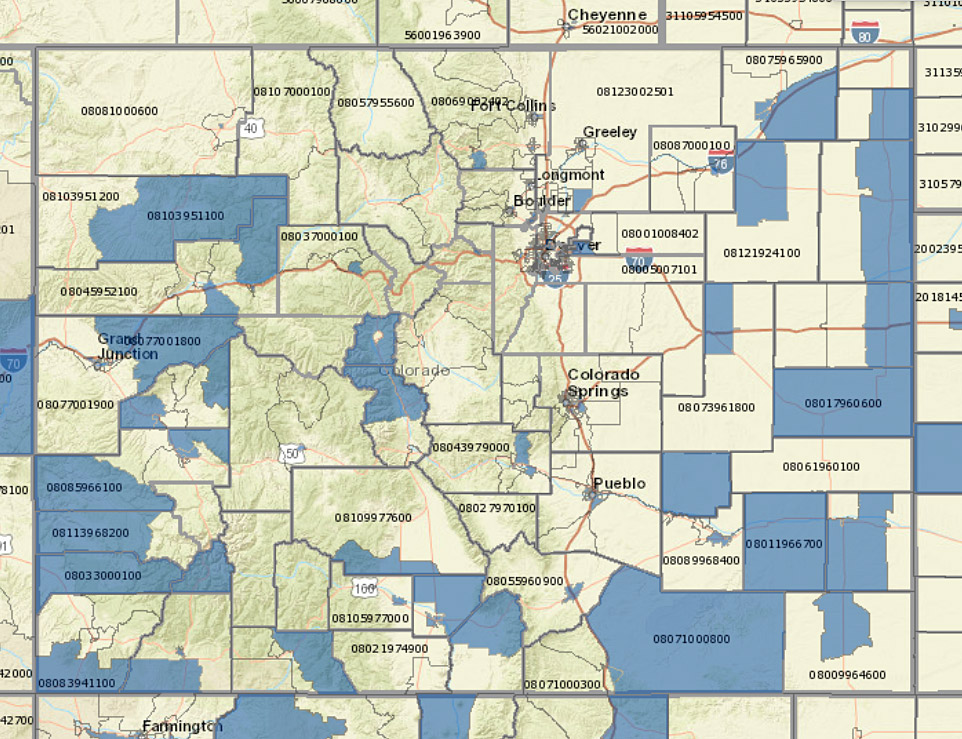

More than 8,700 areas designated as “opportunity zones” in the 2017 Tax Cuts and Jobs Act offer an avenue for certain investments to benefit from tax incentives. Locations include lower income urban, suburban and rural Census tracts. Investors who re-invest capital gains earnings in new investments in these designated areas can avoid paying taxes on those gains. This can represent a significant monetary benefit.

How Do Opportunity Zones Affect Senior Housing Investments?

Investors in opportunity zones are not required to re-invest in a similar asset class. This opens the door for a greater number of investors to look at senior housing, which is emerging as one of the best bets for real estate investment and development

Increased Redevelopment in Urban Areas

Urban areas are attractive to seniors for their walkability, proximity to transit and retail, and easy access to friends and family. Many of the designated opportunity zones are located in thriving urban markets. This creates an abundant opportunity for investors interested in senior housing to acquire property and benefit from a strong renter base while meeting the program requirements for investment in project improvement or redevelopment.

Tax Benefits Could Counteract High Labor Costs

With the large number of baby boomers poised to enter the senior housing market throughout the next ten years, senior housing is an attractive investment. However, already high labor costs are expected to rise in the coming years. The tax benefits realized through investment in opportunity zones have the potential to offset those costs, adding to the attractiveness of this investment.

Increased Investing in Senior Housing

Senior housing is beginning to gain traction among investors. Three out of 78 opportunity zone funds specify senior housing as an investment target, according to the National Council of State Housing Agencies, a Washington, D.C.-based nonprofit advocacy group. Four of the top five senior living opportunity zones are in the southern U.S., while the fifth is in Brooklyn, New York.

Knowledge of the Industry is Essential

As crowdfunding opportunities for investing in opportunity zone businesses proliferate, choosing the right operator partner is key, particularly in the senior housing market. Look for a partner who has experience working with developers and also thoroughly understands residential care communities.

Developers and investors seeking consulting services on planning new developments or refurbishing existing ones will find it advantageous to partner with Colavria Hospitality. We bring a wealth of experience in starting, planning, refurbishing and managing projects with an impressive track record that ensures development of highly functioning residential care communities.

Contact us today to request a consultation.

Opportunity zones offer an exciting way for investors to take advantage of the lucrative senior housing market. Here are a few important things to understand about this type of investment.

Opportunity zones offer an exciting way for investors to take advantage of the lucrative senior housing market. Here are a few important things to understand about this type of investment.